As a university, our influence on the wider world is partly driven by our investment decisions. These decisions reflect our values, organisational strategy and research objectives, while still seeking to deliver acceptable risk-adjusted returns for the University.

UNSW does not typically invest directly in companies, rather exposure is obtained by investing in a range of diversified financial products, usually commingled funds. As a result, we engage with the investment managers of these funds to meet our responsible investment commitments.

By engaging our investment managers and the rest of our community, UNSW aims to accelerate the transition to a sustainable, decarbonised economy.

Commitment:

|

Target

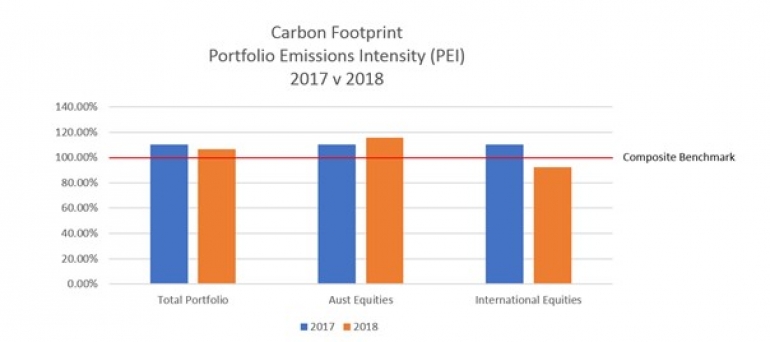

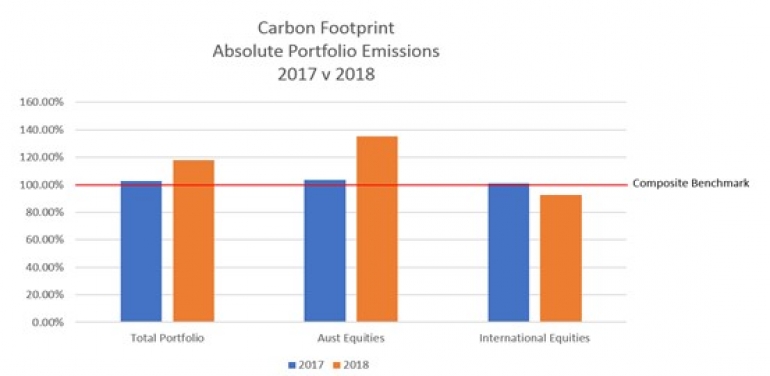

- Align investment portfolio emission intensity with Paris Agreement commitments by 2020.

Activities

- Complete a climate risk assessment in line with the recommendations of the Task Force for Climate-related Financial Disclosures (TCFD).

- Establish a Responsible Investment Framework consistent with the Investment Policy and UN Principles for Responsible Investment.

- Set an investment portfolio emission intensity target and report annually in line with TCFD recommendations.